Is ASML at Its Peak?

ASML down -20% with strong recovery of semiconductor demand.

Hi!

Today’s article will discuss ASML and what happened during its last earnings report. ASML's stock fell 20% after it reported its financial results this quarter, which the market did not react to favorably.

ASML's total net sales came in at €7.5 billion (up 11.9% YoY), exceeding their guidance, driven by increased DUV and Installed Base Management sales. This year's trend showed a decline of 21.6% in Q1 and 9.6% in Q2, due to tougher comparisons, so this recovery could initially suggest that it is poised to reaccelerate its revenue growth.

However, statements from the CEO regarding competitive dynamics and customer caution have raised concerns in the market, leading to the 20% decline in stock price after the earnings report.

“While there continue to be strong developments and upside potential in AI, other market segments are taking longer to recover. It now appears the recovery is more gradual than previously expected. This is expected to continue in 2025, which is leading to customer cautiosness. Regarding logic, the competitive foundry dynamics have resulted in a slower ramp of new nodes at certain customers, leading to several fabs push outs and resulting changes in litho demand timing, in particular EUV. In memory, we see limited capacity additions, with the focus still on technology transitions supporting the HBM and DDR5 AI-related demand.”

Christophe Fouquet 3Q24 Earnings Release.

3Q24 - Numbers by segment

Total net systems sales came in at €5.9 billion (~4% above consensus), consisting of €2.1 billion from EUV (35% of sales) and €3.8 billion from non-EUV sales (65% of sales). These sales were primarily driven by logic (64% of system sales), with the remaining 36% coming from memory.

What surprised me were (i) EUV demand, (ii) logic and memory demand, and (iii) order bookings.

EUV demand – This quarter, EUV sales were approximately 24% below consensus (11% actual growth vs. ~48% consensus growth). EUV growth was expected to be driven by volume, with the unit shipment consensus predicting a +30% YoY increase, due to a demand recovery, while ASP was forecasted to grow by +14% YoY. However, the actual outcome was that volume (units shipped) did not drive growth (4.55% growth, ~20% below consensus), and price was the primary driver of growth (7% growth, 6% below consensus).

Logic and memory demand – Q3 2024 logic sales were in line with consensus (-6% YoY actual growth vs. -5.5% consensus), while memory sales were approximately 16% above consensus (67% YoY actual growth vs. 44% consensus). Over the past four years, logic sales have accounted for over 70% of ASML's net system sales, but this quarter, it declined to 46%, with year-to-date figures at about 60% of net systems sales.

Order bookings – Total system bookings were approximately 50% below consensus (+1.19% YoY actual growth vs. +115% consensus growth), driven by a volume decline (-33% YoY, ~40% below consensus).

Overall semiconductor demand is insane

One of the comments made by Roger Dassen, ASML’s CFO, regarding end-market demand caught my attention:

“There continued to be pressure on free cash flow. This is primarily due to a relatively lower level of order intake and therefore less down payments as well as higher inventory level. The higher inventory level is primarily attributable to EUV, both high NA, and low NA driven by longer lead times in the build cycle as well as inventory in support of future ramp. The relatively low order intake is a reflection of the slow recovery in the traditional end markets as customers remain cautious in the current environment.”

- Roger Dassen 3Q24 ASML Earnings Call

This caught my attention because when I looked at TSM’s 3Q numbers and C.C. Wei’s comments, the reality seemed quite different. TSM is ASML’s main customer for lithography equipment. While C.C. tends to be optimistic about end-customer demand, the numbers aligned more with his comments than with Roger Dassen's.

TSM Results: Sales were up 36% in USD, marking a strong recovery from previous quarters (-10%/-11%/0%/+13%/+33%).

Smartphone: Up 21.8% YoY, 16% QoQ

HPC: Up 71% YoY, 11% QoQ

IoT: Up 6% YoY, 35% QoQ

Automotive: Up 26% YoY, 6% QoQ

DCE: Down 15% YoY, 19% QoQ

Other Revenue: Down 21% YoY, up 8% QoQ

Most of ASML's demand comes from leading-edge technologies (<7nm chips), due to the critical role lithography plays in manufacturing. C.C.’s comments on the near-term demand outlook indicated a strong recovery, with no signs of caution regarding this technology segment as Roger Dassen (ASML CFO) said.

“Our business in the third quarter was supported by strong smartphone- and AI-related demand for our industry-leading 3-nanometer and 5-nanometer technologies. Moving into fourth quarter. We expect our business to continue to be supported by strong demand for our leading-edge process technologies.”

- C.C. Wei 3Q24 TSM Earnings Call

In the Q&A, C.C. responded to a question about overall semiconductor demand, stating that he believes the demand is insane and just beginning.

“The demand is real and I believe it's just the beginning of this demand, all right? So one of my key customers said, the demand right now is insane, that it's just the beginning”

- C.C. Wei 3Q TSM Earnings Call

They also discussed capital expenditure plans. Jen-Chau Huang (CFO) mentioned that 2024 capex will be slightly higher than $30 billion due to strong structural AI-related demand.

“Next, let me talk about our 2024 CapEx. Every year, our CapEx is spent in anticipation of the growth that will follow the future years. And our CapEx and capacity planning is always based on the long-term market demand profile. As the strong structural AI-related demand continues, we continue to invest to support our customers' growth. We now expect our 2024 CapEx to be slightly higher than USD 30 billion.”

- Jen-Chau Huang 3Q24 TSM Earnings Call

From FINFET to GAAFET

Given all the comments about recovering end markets, future demand for leading-edge nodes, and capital expenditure plans, why didn’t ASML beat consensus? In my opinion, it’s due to the transition from FINFET to GAAFET technology.

TSMC has already announced that its N2 Nanosheet technology will utilize GAAFET and is expected to commence high-volume manufacturing between 2025 and 2026. TSMC anticipates a 25%-30% power reduction at the same speed and a 15% increase in chip density compared to its previous N3 process.

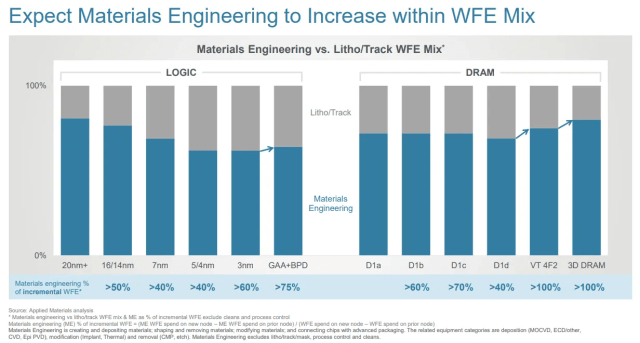

As this transition takes place, the importance of lithography in the manufacturing process is expected to decrease, while etching will become the critical step. This shift could lead to a reduction in lithography spending as a percentage of overall wafer fabrication equipment (WFE) expenditures, benefiting etching technology.

We can observe this transition in one of C.C. Wei's comments regarding the use of more advanced technologies:

“Our second and third fabs will utilize more advanced technologies based on our customers' needs. The second fab is scheduled to begin volume production in 2028, and our third fab will begin production by the end of the decade.”

- C.C. Wei 3Q24 TSM Earnings Call

Additionally, following Doug O'Laughlin at Fabricated Knowledge, 3nm chips represent the pinnacle of lithography market share gains, which is not favorable for ASML.

“Another way to interrupt this statement is that EUV intensity is peaked if they think the DUV attach rate is growing as fast as EUV. This has been a long time coming, and Applied Materials puts it well in this slide – 3nm is the apex of lithography market share gains. This is not good for ASML and the EUV story.”

And how are we that surprised? Most innovations have been explicitly focused on reducing the EUV layer count. I’ve said this repeatedly, but you can argue that Sculpta, reduction of EUV layers at TSMC, and even BSPDN are about removing EUV layers. When the entire industry plans to use less EUV, lithography is peaking.

The last decade has been the decade of Lithography, and I can almost assure you that Lithography spending will grow slower in the next decade than WFE [Wafer Fab Equipment]. And let’s not forget that in the decade before EUV, lithography was only 15-20% of the expenditure. I believe that lithography will revert to the mid-20s of WFE.

I think it’s time for investors to accept the decade of lithography is over. The premium ASML has slowly gained for itself for the last decade should end as the decade of litho ends. And the recent price move has been a collapse of that premium. I believe it should trade in line with other semi-cap companies, as I’m sure that Litho will not outgrow WFE but will be valued for its strong monopoly.”

So, we will likely continue to see ASML miss expectations as their sales and bookings decelerate, with lithography losing market share in overall WFE expenditures compared to etching, which could result in a downgrade of ASML valuation multiple in the future.

Interesante. A parte de la moda del stacking hay otro factor que puede afectar a la demanda de maquinaria de ASML en los próximos años (en esto caso de manera positiva) y es la inauguración en 2026 de las nuevas fábricas en USA de TSM, MU e Intel que seguro que necesitan muchas máquinas EUV.