The Opportunity in Card Payments: Mastercard and Visa’s Strategic Moves

How Mastercard and Visa Are Positioning Themselves for Growth in the Digital Payments Revolution

Hi everyone!

After seeing Mastercard´s Investor Community Meeting, I wanted to share with you a few thougths that I had.

What did called my attention was how their strategy was not changing at all. The opportunity, the go-to-market strategy, the use cases, the virtuous cycle… everything remained the same. But I wanted to share some thoughts around the shift to digital.

The Shift to Digital

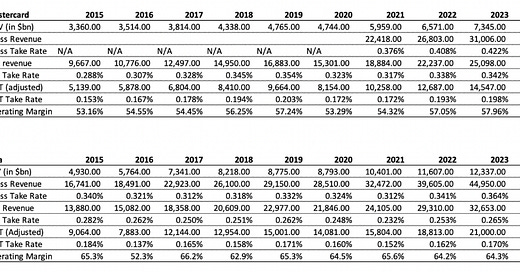

The main opportunity for the payment networks remains to be the shift from checks and cash to digital payments. There are $35Tn payments opportunity in check and cash between consumer purchases ($11Tn) and new flows ($24Tn), compared to the $26Tn that are already in card payment networks.

We could say that this opportunity is easy for Mastercard, Visa, or American Express to be penetrated. Nevertheless, there are some economies that still have >50% of its payments done by cash.

This is because cash is one of the most private payments methods in the world, as it does not record any data of its payment. You just need to verify that the cash is not false. Nevertheless, the cash is not as ease and safe as a carded payment transaction, and who decides how the transaction is going to be done are the suppliers (merchants).

For the merchant, the most important part of the payment is the acceptance, which also is the most important part in the supply chain, because if there is not any acceptance point, the payment wont be enabled. And cash, is the riskier payment method for the merchant, as it could be false, it could be robbed, it deteriorates over time, or it could make it harder for business owners to manage their finances/accounting.

However, card payments networks are extremely safe, because acquirers and issuers (merchants and consumers banks) need to comply with some rules in order to allow them to connect to its network to make payments. Those rules are related to identity solutions, cybersecurity, settlement times, passwords, or banking services.

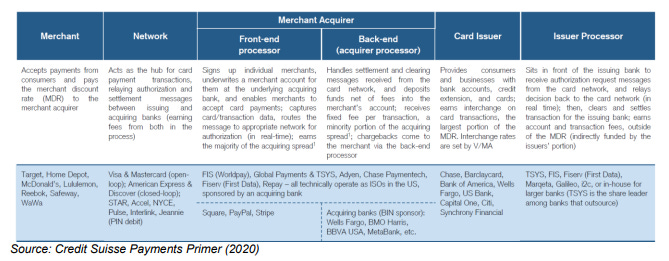

For those who don´t know how carded payments work, those payments have a few steps, that add security layers to enable the payments. Let´s see how

explains how a payment works:“While it may seem you just pull your credit/debit card out of your pocket at Point of Sale (PoS) and in a few seconds your payment is deemed successful, there is a dizzying amount of work being done in the background in the meantime.

Once you insert the credit card into the Target’s PoS, your card credentials and transaction data are captured, and then the merchant acquirer such as Adyen sends the data to the card networks (Visa/Mastercard) who subsequently queries the customer’s issuing bank for authorization (fund availability, fraud checks, risk analysis etc. are also done here). Once green lighted by the issuing bank, the authorization flows through the card networks to the merchant acquirer (e.g. Adyen), and the merchant (the retailer) receives confirmation from its merchant acquirer that the transaction is authorized, and then the sale is completed. This is called the authorization phase. Then the settlement phase starts.

To start the payment process, the credit card issuing bank provides credit on behalf of the customer to settle the transaction which is routed through the card networks who then passes the transaction to merchant acquirer’s back-end processor for settlement. The back-end merchant processor then settles the net outstanding balance between the card-issuing bank and the merchant acquiring bank (where the merchant has its merchant account). The merchant bank will then credit the merchant’s account for the amount of the purchase, less fees charged (i.e. Merchant Discount Rate or MDR) for facilitating the transaction across multiple parties.”

In the authorization step, the card network (i) analyse the consumer funds availability related to the liability he is going to issue, (ii) assess the risk of this transaction, (iii) record the history of the consumer payments, (iv) verifies that all this information is true, and (v) the issuer bank will transfer the money to the merchant (assuming a liability risk if the consumer does not have the funds required for the payment).

Carded payments have the highest rates of security because (i) they collect the biggest amount of data from merchants and consumers, (ii) acquirers and issuers have to comply with several security rules to be able to make payments, and (iii) if any of the parts, the consumer or the merchant, does not settle their liability, their bank will assume the liability. So, in a carded payment transaction all the incentives are aligned to enable safer payments, and that is why it is becoming the most preferred payment method for businesses.

From Card-Present to Card-Not-Present

As the digital payments have expanded its use cases and penetration, we have seen how digital payments fraud have also expanded.

When we think around digital payments, there are mainly 2 kind of payments in a card payment network, (i) card-present, and (ii) card-not-present payments.

This is basically, when the consumer is realizing the payment in person, and when he is not. This difference is really important in the payments industry because as the consumer is not present, it adds a significant risk to the payment.

Imagine someone, who wants to buy a product/service from you, and they tell you they will pay you in cash by postal mail, instead of coming and giving you the cash in person. The same problem happens with digital payments, but the difference is that it could be a russian hacker, who is making a fraudulent payment.

Historically, carded payments have been realized in person, with a card, which has a PIN password, and you need to wait for the transfer to be confirmed. Now, you are probably selling your digital goods to people who are not even in the same continent as you, where banks do not comply with the same national banking regulation, and could have some other issues that add significant risk to the transaction.

This is why card payments have become so important, because they have add some rules that every bank need to comply with to enable their payments globally, and then they are the ones who have the best data to enable those payments in a safety way.

So, with this accelerated digital trend, carded payments systems are becoming more and more important.

Mastercard´s Strategy and Visa´s Unit Economics

The increased risk in payments due to gloablization and the digitalization of the world has accelerated the adoption of card payments from merchants, which is the first step of the expansion of a payment system.

The way you expand your penetration in this industry is (i) you develop an offering for merchants, (ii) you increase your acceptance, so consumers can access to the supply they want through those networks, and (iii) you attract consumers to your network, so you drive total processed volumes up.

To penetrate this industry, and expand their acceptance, Mastercard has been very focused on becoming the main partner for the new digital players. Mastercard was the first one in the industry to start doing value added services for those partners.

Mastercard saw the opportunity of building partnerships with online players (PSPs, ISVs, Gateways…) because their peers were focused on increasing their reach with the large banks. Mastercard started to offer new services to their ecosystem, which increased the percentage of transactions those partners moved to the Mastercard Network.

The approach Mastercard took to drive the adoption of those partners was by becoming the advisor for those partners, and offering them (i) cybersecurity solutions, (ii) business insights, (iii) PSPs and Gateways solutions, (iv) tokenization and authentication, and (v) open banking.

Most of those services had great adoption by their customers, with ~30% of Mastercard´s revenues coming from those services. So, Mastercard started to gain market share in the digital acceptance side due to this partners. Then, the pandemic arrived, and the digital world accelerated, so we saw how Mastercard was the most benefitted payment network from this new environment due to the investment they did.