Hi everyone! I usually wirte in spanish, but now on I will do it in English. This is the international language, and I don´t want it to be limited to spanish people.

Today I´m bringing to you a really interesting company which we have incorporated to our portfolio at $67 on October 17th. So our portfolio is right now:

Meta Platforms

Adyen

Ritchie Bros (RB Global).

As you will see, we have sold Intel, because it has given us 33% return and I think it is pretty expensive right now.

After explaining how the portfolio is after this recent acquisition, let´s move to the investment thesis of RBA.

Summary Thesis

RBA it´s a good business (~20% historical op. margins) with resilient competitive advantages and a huge growth opportunity (>$300bn TAM with $1.7bn revenue) that it´s being executed well through acquisitions.

Growth levers:

Auctions market growth ~3% CAGR (GDP growth).

Transition to online with satellite sites could accelerate growth over 10% cagr with a significant margin expansion to 25-30% margins in this decade.

Over 20% revenue growth due to new flows because of the evolution into a marketplace with transaction solutions in new markets, insights and services.

Company

What does the “Company” do?

Ritchie Bros Auctioneers began as a small family-run business in Kelowna, British Columbia, Canada. The 3 Ritchie brothers conducted their first unreserved auction in 1958, selling CA$2,000 of surplus inventory to pay a bank debt. Their success made them to conduct in 1963 their first major unreserved industrial auction, selling CA$600,000 worth of equipment. 27 years after that (1985), the company sold more than one billion dollars in equipment, and 3 years later the second billion. Today, they are the world's largest industrial auctioneer, selling billions of dollars of used and unused equipment at hundreds of unreserved public auctions per year.

The principles of Ritchie Bros Auctioneers auctions are simple, (i) the auction is unreserved (there are no minimum bids and no reserve prices) and (ii) every item is sold to the highest bidder on auction day. Bid-ins and buy backs are also forbidden.

Nowadays, Ritchie Bros Auctioneers is a world leader in asset management and disposition technologies for commercial assets, used equipment and other assets. Construction and commercial transportation assets comprise the 75% of the equipment sold by GTV dollar value.

They report in 2 segments.

Auctions and Marketplace (~88% of revenue - 85% of operating profit) - Consists of the company´s live onsite auctions, its online auctions and marketplaces, and its brokerage services. They offer consignors several contract options, (i) Straight commission contracts, where the consignor receives the gross proceeds from the sale less a pre-negotiated commission rate; (ii) Guarantee contracts, where the consignor receives a guaranteed minimum amount plus an additional amount if proceeds exceed a specified level; and (iii) Inventory contracts, where they purchase, take custody, and hold the assets before they are resold in the ordinary course of business.

Ritchie Bros. Auctioneers (Live Onsite Auctions): This is unreserved onsite auctions, with live online simulcast, where they have care, custody and control of consignors assets.

IronPlanet: Online marketplace with featured weekly auctions and providing the IronClad Assurance equipment condition certification. They have achieve to solve the inspection problem, providing videos, photos, reports about the equipment you´ll buy so you have a good understanding of the quality of the product before buying it.

Marketplace-e: Controlled marketplace offering multiple price and timing options. It is a classic online marketplace, where you can buy and sell equipment.

GovPlanet: Online marketplace for the sale of government and military assets.

Private Treaty (Brokerage Service): They assign you a private sales agent, that will asses your needs and facilitates private treaty negotiations for a wide variety of specialized and high value heavy equipment and industrial assets. Ritchie Bros will inspect the assets so you can make an offer. All those negotiations will be handled confidentially.

IAA: Digital marketplace that connects vehicle buyers and sellers and facilitates the marketing and sale of total loss, damaged and low value vehicles for a full spectrum of sellers.

Other Services (~11% of revenue/15% of operating profit) - Other Services include financial services, appraisal and inspection services, listings and value added services. Those value added services are mainly created to achieve the most complete and the best quality of their services, because some of them are completely free and are used to achieve a better position in the market.

Financial Services (~4% of revenue): Loan origination service that uses a brokerage model to match loan applicants with appropriate financial lending institutions.

Rouse (~2% of revenue): It provides Data & Analytics to the customers. Rouse is the leading provider of rental metrics benchmarks and equipment valuations to lenders, rental companies, contractors and dealers. Rouse has 2 offerings, (i) Appraisal Service, where they provide unbiased and certified appraisal services and (ii) Data Service, where they provide equipment market intelligence.

SmartEquip (1.2% of revenue): A digital marketplace that connects equipment owners with parts manufacturers.

Inspection Services: They deliver enhanced inspection for items. Their inspections are recognized by the industry because the reports include, (i) photos, (ii) ratings & comments, 5 (iii) functional test results, (iv) engine videos, (v) transmission function, (vi) track/tire tread depth gauge and (vii) lab analysis of oil & fluids.

Online Listing Service: Online equipment listing service and B2B dealer portal.

Ancillary Services. Repair, paint and other make-ready services.

Logistical Services: End-to-end transportation and customs clearance solution for sellers and buyers with shipping needs.

Software Service: Cloud-based platform to manage end-to-end disposition.

Breakdown of the revenue - Ritchie Bros operates in 13 countries, maintains a presence in 42 countries where customers can sell from their own yards with >2,800 full-time employees.

Ritchie Bros. is pretty concentrated in US where is the biggest TAM (10:1 Canada) and it is the fastest growing revenue of the company (~15% CAGR).

US ~ 56% of revenue

Canada ~ 22% of revenue

Australia ~ 10% of revenue

Europe ~ 8% of revenue

Other ~ 4% of revenue

Strategy - The company is trying to convert its business into a marketplace with 3 segments, (i) transaction solutions, (ii) insights and (iii) services. All this marketplace will be focused on the Inventory Management System (IMS), which is a platform that will unify mostly all of Ritchie Bros. services for buyers and sellers. Their actual strategy is focused on aggregate the offering into 3 segments:

Transaction solutions: Where they will offer solutions to connect buyers and sellers through auctions, private marketplaces, listings, reserved or private negotiations.

Insights: Ritchie Bros. will provide data so their customer can assess their decision making better and accurately value the assets.

Services: In services, RBA will provide value added services as inspections, advertising, storage and a wide set of complementary offerings.

They are also changing the way that their logistics work. They historically have had big yards where they were keeping all the inventory for the auctions, but with the online transition, they´ve changed this kind of yards, into what they call satellite sites, which are small and better logistically positioned. So, instead of going from Michigan to Tenesse to buy some industrial equipment, those satellite sites are probably nearer from you.

Supply Chain

The used equipment market follows a long path until it goes to auctions. The first stage of the supply chain is when the new equipment comes to the market. The new equipment is produced by the Original Equipment Manufacturers (OEMs), who sell directly to the market or through Dealers or Retailers (they also could rent with rentals). When this equipment has been depreciated enough, the personal owners decide to sell this equipment. As RBA is trying to become a marketplace, the way to think about them is as a whole market:

Sellers/Consignors: Individuals, companies or government looking to sell equipment or assets. They provide the inventory to the market (auctions/private sales/retail).

Inspection & Valuation: Experts who assess the condition and value of items to be sold, which helps in setting a fair starting bid and ensuring transparency to buyers.

Transport & Logistics: They are the ones who transport consigned items to auctions sites or storage facilities. This might involve partnerships with shipping and logistic companies.

Auction sites: Physical locations where live auctions are held. These sites display items, allow for pre-auction inspections by potential buyers, and facilitate the actual auction event.

Online Platforms: Online platforms who allow to conduct auctions digitally, reaching a wider audience and facilitating sales beyond physical auction locations.

Bidders/Buyers: Individuals, companies, or government looking to purchase equipment or assets. They are the customers who participate in the auction, either on site or online.

Payment & Financial Services: Handle the monetary transactions post-auction, ensuring sellers receive their money and buyers are provided with financing options if necessary.

Post-sale Logistics: They handle the transfer of ownership and the transportation of items to the buyer after the item is sold.

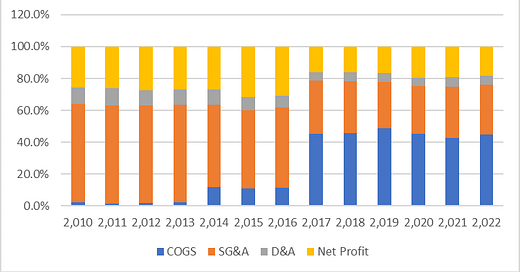

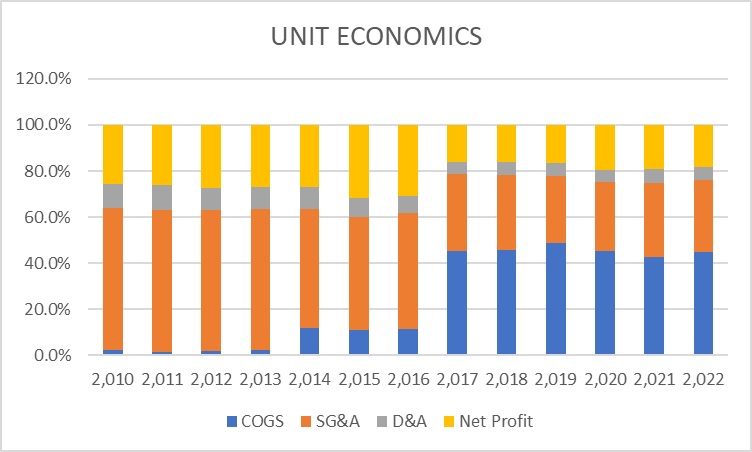

Unit Economics

It is not possible to know what are Ritchie Bros unit economics because they have not a standard price or product because they are an auctioneer. But although, we know that they charge 28% over its GTV, then they spend 44.8% in COGS, 31.1% in opex and 5.6% in D&A, having a 18.5% EBIT margin.

Market Shares

Ritchie Bros. Auctioneers industry structure is divided into 3 markets, (i) Auctions ($30bn), (ii) Private Sales/Brokerage ($140bn) and (iii) Dealer/Retail/Rental ($130bn), that are pretty fragmented by type of asset, service offered or data, so there are more markets that it seem to be (pretty hard to get trusted information).

From the $300bn market, RBC estimate that $80-$90bn comes from the construction end-market (50% from US and Europe)[1], $75-$90bn from transportation end-market (60% from Europe and US)[2], $60-$65bn from Agricultural end-market and oil&gas is unknown (need to deep here but it should be between $55-$85bn).

So from every market, in terms of total GTV, RBA has a market share of:

3.5% in Construction.

1.8% in Transportation.

1.2% in Others (agricultural and oil&gas).

Auctions Industry - According to RBA it is a $30bn market and Ritchie Brothers has $6bn of GTV so a 20% of market share. There isn´t any info about the market shares and competitors so I don’t know the real market shares. Historically this market has had pretty high barriers of entry because you need really big places to make the auctions and to place the assets, so the customers could see the assets. In the latest years this is changing because there are more and more online auctions, and this market is expected to accelerate its growth to 18% CAGR the next 5 years. This could benefit Ritchie Bros. financials but change the market barriers of entry, because there won´t be so many investment requirements than they used to.

We could differentiate this industry between the different kinds of assets that are sold:

Salvage vehicle market: With the acquisition of IAA, Ritchie Bros. has entered into this market, that has an oligopolistic structure between the 2 main players, Copart and IAA, who have ~40% of market share each one. “We are one of the two largest providers of marketplaces for total loss, damaged and low-value vehicles in NA with approximately 40% market share”-“We estimate that IAA and Copart together represent over 80% of the NA market.

Construction: Market sh unknown.

Commercial transportation: Market sh unknown.

MOATs

Auctions - The auction market in general is determined by the quantity of liquidity that they bring to the market, the more buyers and sellers a company is capable of bring to their auctions, the better business it is, because the only thing that the sellers and buyers want to, is to find its counterpart of a transaction. The commercial assets auctions market historically has had big barriers of entry because this market had big investment requirements because you need to have big places to hold and custody the commercial assets so the buyers could go to see the assets and make sure of the quality to know their fair price. With the entry of the online trend it changed, so people could see the quality of the products through videos, photos or outsourcing the inspections. It creates an opportunity for bigger companies to improve their economics, not having those big places to hold the assets but having satellite sites (smaller places to improve logistics) because they don’t need anymore to have everything in the same place that the auction is going to be done. It reduces the investment requirements of the market, but it is a market that tend to be aggregated because you want to have all the supply in the same supplier, so you don’t have to do research as a buyer over the different suppliers.

RBA moat:

Scale: Largest auctioneers have significant advantage. The larger you are, the better logistics you could have. You will have a bigger network of sellers and buyers, so you can have a satellite site (more distribution) so the transportation and custody costs will be lower. Because you will have those assets closer to the sellers and buyers. And with the acquisition of IAA they will be the largest company in the US with +210 yards (60 ex-acquisition) located near high population areas, followed by Copart with 180 yards.

Network Effect: Like with the scale, largest auctioneers have significant advantage. The larger you are in terms of GTV, sellers and buyers, the better the place to sell/buy. So it creates a flywheel, where if it is the place where sellers and buyers are, it will be the place where more sellers and buyers will go.

Ritchie Bros. actual position brings to them the opportunity to penetrate much bigger markets than the ones that they’ve been penetrating until now as they accelerate their logistics expansions and their sales force, while they improve their margins with the satellite sites.

Structural Growth

RBA has been consistently raising their fees/commissions over the last 10 yrs, mainly driven by the digitalisation of their offerings and the complement services they offer to its customers as inspections, financial services or listings. So we could say, that they have really high pricing power, because they have raised consistently their prices.

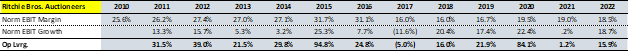

RBA has historically improved their margins, from 2010 until 2016, but after the IronPlanet acquisition they lost 15% margin because of the change in the business, even after increasing that much its take rate, but this is because the change in accounting because of the inventory business which is much more capital intense. They didn’t include in their financials the total value of the items, they just included the fee charged (difference between what was paid and charged), so this year their revenues increased >70% and their margin was reduced ~50%.

IAA due to its short life as a public company, it is hard to say what are normal values, but we can say, that this business has ~20% EBIT margins, with high operating leverage because most of its costs are fixed.

RBA´s return on capital employed has been improving consistently (except for 2017 because of accounting rules change and IronPlanet acquisition) the two periods of the company (2010-2016, 2017-2022). This is because the nature of the business, which is very capital intense in the beginning, with high capital expenditure needs, which, as they increase their network effect and their scale economies, their return on capital employed improves over time.

Financials

P&L (RBA):

Ritchie Bros revenue has increased ~14% CAGR since 2010. Between 2008 and 2012 (during one of the biggest recessions in history), they had ~12% revenue growth, being accelerated in 2009 (~14%). It is because the auctions business is anti-cyclical, because you buy/sell equipment there when you cannot go the new equipment dealers/retailers. In 2013 the revenue growth started to decelerate because of a decline in the average GAP per industrial auction from $16.5mn to $14.3mn because of the mix in age of equipment, they were selling older assets because the owners during the recession were expanding the replacement cycle of their equipment, so their equipment was getting older. Since 2014 the revenue growth accelerated because of the development of their service offering, they were charging more fees for more services by asset. And in 2017 the financial business model changed because of the inventory sales inclusion, they started to report that they buy inventory and sell it, so their revenue wasn’t the commission they were charging, it was also the value of the inventory they were selling.

Ritchie Bros COGS have increased ~45% CAGR since 2010. The main reason why it has increased so much, was because of the inventory sales inclusion in 2017 that changed its gross margin from ~90% (before 2017) to 55% (after 2017) because they started to buy the inventory to sell it later, so their gross margin decrease because of the inventory costs.

Opex has grown ~8% CAGR since 2010, following a pretty linear growth. It has had some one-off year impacts like acquisition related costs in 2017, 2021 and 2022. But normalized has been increased ~8% CAGR since 2010. It has resulted in a EBIT margin of 27% from 2010 until 2014, 31% in 2015-2016 and with the inclusion of inventory sales it has decreased to 16% in 2017, that has been increasing to 18.5% in 2022. So, EBIT has grown ~11% CAGR since 2010.

P&L (IAA):

IAA Inc has grown its revenue a 11.5% CAGR since 2017. In 2020 they had degrowth because of covid crisis.

IAA COGS has grown ~12% CAGR. The reason why it is a higher growth than the revenue is because the rise of vehicle prices in 2021/2022, when the COGS grew 31% and 23% respectively. IAA OPEX has grown ~13% CAGR, having its fastest growing year in 2021, with an increase of ~33%.

IAA EBIT has grown ~12% CAGR. The reason why they have not had operating leverage has been because of the vehicle prices and salaries going up during 2021 and 2022.

Cash Flows (RBA):

Ritchie Bros. norm operating cash flow has grown ~13% CAGR since 2011. It was negative before 2011 because they were trying to expand their business through massive capital expenditures that were annually >$100mn). Since 2011 the norm op cf margin has been ~18%, the last 5 years has been 12.5% and the last 3 yrs ~14%. The decrease in 2017 is because of the more capital intensity business of selling inventory, with a much more unpredictable WC.

Historically the capex realized by the company over sales has been decreasing from 15% in 2010, to ~3% in the last 5-3yrs, because in 2017 with the acquisition of IronPlanet, they started to change 100% to online, so they didn’t need to have that much yards/locations (they’ve been selling some of the locations the last few years).

Cash Flows (IAA):

IAA Norm op CF has grown ~17% CAGR. This growth is because the reduce of the maintenance capex and WC over sales which has produce a higher cash conversion in the company. The years that it has had negative growth has been because of WC negative impacts, which has reduce substantially the FCF generated by the company due to the increase in accounts receivables because of a higher demand of their services.

Another curious thing about IAA cash flows is how much taxes are they paying, because their cash tax rate (~34%) much higher than their net profit tax rate (~23%), because of WC impact.

Assumptions

Auctions: Historically Ritchie Bros. has operate the auctions market. This segment has grown a ~13% CAGR and they already have 20% of market share. This market is expected to grow 18% CAGR for the next 5 years with the online transition (need to deep more here to check). They are the ones that bring more liquidity to this market and they already have been penetrating the online market since 2017 (IronPlanet acquisition).

Apart from the auctions market, we have some optionality that can accelerate Ritchie Bros financial growth over the next years (It could be a game changer of the thesis – pending to deep more):

With the IAA acquisition numbers, we can expect an acceleration of its financials because they’ve expanded from 60 yards to +210 (3.5x locations).

Penetration into 2 new markets (marketplaces and services) that increase its TAM 10x (from ~$30bn to ~$300bn), which I expect will accelerate the topline growth because maintaining market shares (~20% GTV) they will process more less $60bn.

Economies of scale and online transition will accelerate its margins expansion (+5-10%) with satellite sites through the next 5 years.

Capital Allocation

They have historically allocate capital through acquisitions which have been financed with the issuing of debt. The main acquisitions they’ve done in the last 10 yrs are:

IronPlanet: On May 31, 2017, Ritchie Bros. acquired IronPlanet Holdings for $776.5mn with $5bn sold between 1999-2016 and 1.5mn users. This acquisition allowed them to access to the online auctions market, which they used to create Marketplace-e so they could access new markets.

Mascus: Acquired in 2016 for $26mn for the 100% of its equity. It has allow them to access the listings market, so they have penetrate into the private sales/brokerage market (35M listing per year/+$75M direct annual revenue opportunity)

SmartEquip: On Nov 2, 2021, Ritchie Bros. acquired SmartEquip for $175mn, which has make $20.5mn of revenue in 2022 (first year from acquisition). It has allow them to access to the equipment parts/pieces market, which they think it could be between $100bn-$150bn of annual revenue. I am not pretty sure about that because it could create a interest conflict inside the company (need to deep about this).

Rouse: On Dec 8, 2020, Ritchie Bros. acquired Rouse for $275mn ($250.3mn of cash - $22mn in common shares/0.3% of equity). This acquisition was made to improve the data collection/analytics inside the company so it will improve their penetration into (i) Fleet Data, (ii) Sales transactions data, (iii) Rental invoices data and (iv) rental companies P&Ls data. This acquisition improved substantially the customer experience, and help them to make better decisions because provides them more/better information.

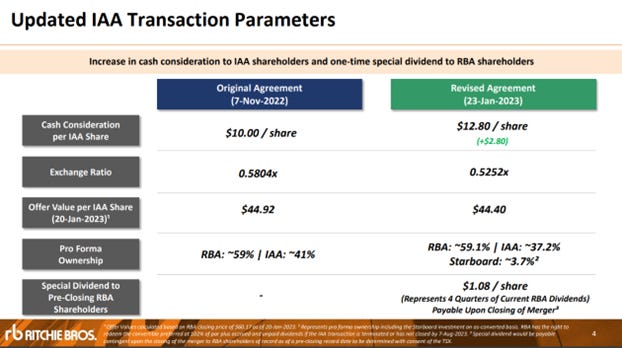

IAA: On March 20, 2023, Ritchie Bros. acquired IAA for $6.6bn. IAA stockholders received $12.80 per share in cash and 0.5252 shares of the company for each share of IAA. The company paid $1.7bn in cash consideration and issued 70.3mn shares (63.4% of equity) of its common stock. With it the company repaid $1.2bn of IAA´s net debt and $500mn of IAA senior notes, at a redemption price equal to 102.75% of the principal amount plus accrued and unpaid interest. This acquisition will improve substantially the logistics situation of the company elevating its yards location to +210 in the US, which will accelerate the growth and expansion of Ritchie Bros. financials in the short/medium term.

Management

James F. Kessler (CEO) - Fandozzi (previous CEO) created the COO position and hired Kessler to lead some changes inside the company. Fandozzi said that Kessler´s mission in the company is to change 60 years of Ritchie Brothers and 20 years of IronPlanet operations into one cohesive customer experience. She said that his job is to deliver the best customer service with the lowest cost to serve with the highest share of wallet. He has experience in the industry in 3 companies, (i) vRide which is a ridesharing company, (ii) ABRA Auto Body & Glass, for automotive repair needs and (iii) Caliber Collision, which is another company of collision repair services. Kessler directed the integration of Caliber Collision and ABRA Auto Body & Glass to create the largest consolidator of the repair industry. So, make sense that he understands the synergies after IAA acquisition, and the needs that industry could have with value added services as inspections, items, and so on.

Incentive plan - Right now, RBA management team is not consolidated, because they are looking for a CFO (Megan Cash currently), so the compensation structure is probably going to change when they find the new CFO. But, nowadays the compensation plan is formed by a base salary, and a variable compensation which is determined by the earnings growth CAGR, the cumulative operating free cash flow per share and the absolute share price appreciation.

Key Shareholders

After the IAA acquisition, the ownership of RBA is divided into RBA has 59%, IAA 37% and Starboard a 4%.

But, with this acquisition, we appreciate that there is only one director with substantial ownership of the company, Jeffrey C. Smith (CEO & CIO of Starboard), who has the 3.73% of RBA.

What Matters?

Thesis - RBA it´s a good business (~20% historical op. margins) with resilient competitive advantages and a huge growth opportunity (>$300bn TAM with $6bn GTV) that it´s being executed well through acquisitions.

Growth levers:

Auctions market growth ~3% CAGR (GDP growth).

Price lever due to the online transition and new services (>10% revenue growth).

>10% GTV growth due to the penetration into new markets

Risks

Management execution: There has been some management changes in the last years that could create a significant doubt about the commitment that the management team has with the shareholders.

Electric Vehicle: Electric Vehicles could create a significant risk for IAA business because with software improvements those kind of vehicles could be much safer than the actual vehicles and in-house software could create an opportunity for OEMs to take market share in this business. Also, an accident of a electric vehicle is more likely to be a total loss, and if it is not a total loss it is more expensive than a traditional one because of the nature of the items.

Transition to online: The customers in those markets are use to go to see the vehicle by themselves, so the transition from physical to a digital trusted solution could be much slower in terms of customer decision making.

Valuation

As you all know, my valuations tend to not be pretty sophisticated, because I don´t think there is an exact target price for companies, instead of a target price I usually use FCF yield + FCF growth as an estimation of approximate return. In this case, RBA is at ~4% FCF yield (FCF/EV) and I expect the FCF to grow something near ~12%. So, we should expect a return close to ~15% in the next years, with some optionality from new flows (loans, listings or asset management).